The facility of AI and predictive modeling in funding determination making

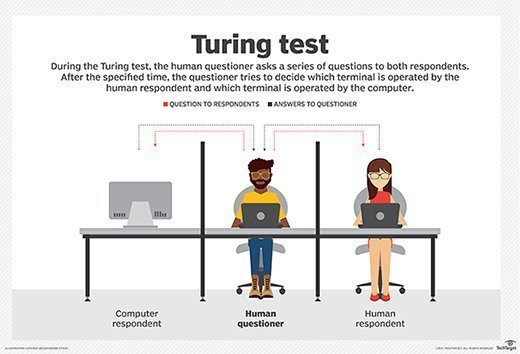

Alan Turing first spoke about AI in 1950, asking, ‘’can machines assume?’’. In as we speak’s period, I might outline Synthetic Intelligence because the science and engineering of creating clever machines and laptop packages that perceive the intelligence of people. AI could also be one of many greatest technological leaps in historical past, and is poised to unlock new enterprise fashions, rework industries, reshape individuals’s jobs, and increase financial productiveness, thereby ushering in a modern-day industrial revolution. It’s primarily a statistical method that leverages Machine Studying and knowledge mining to foretell and forecast future outcomes via evaluation of present and historic knowledge.

Utilizing AI in funding decision-making gives a big benefit. It may possibly shortly analyze huge quantities of knowledge as towards the standard methodology the place some key numbers could possibly be ignored by human analysts. With its functionality in figuring out patterns and traits, AI algorithms can analyse numerous knowledge varieties, corresponding to social media sentiment, information articles, and monetary statements, to determine alerts and make predictions about an organization’s future efficiency.

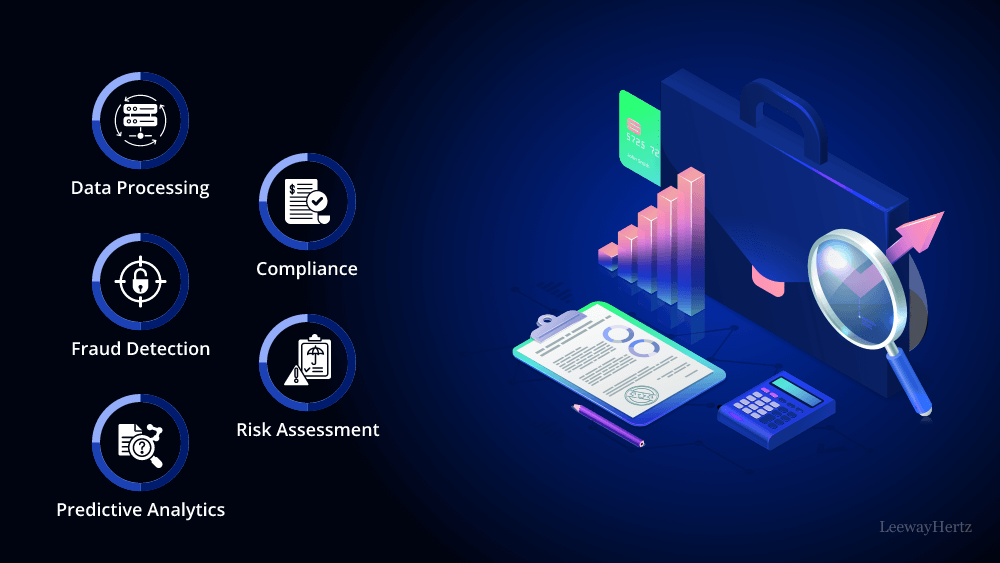

Helping buyers in making extra knowledgeable choices, decreasing dangers, optimising funding portfolios and order movement, executing giant orders, bettering effectivity in monetary markets, could be enhanced by AI. AI is the truth is reworking the lending business, streamlining knowledge processing for extra environment friendly creditworthiness evaluations of potential debtors, optimising underwriting processes, and enabling more practical administration of lending portfolios.

The facility of AI and Predictive Modeling additionally permits firms to rely much less on human intervention and cut back overheads. The section of neoclassic financial system is lengthy over, whereby it was assumed that solely people might make well-defined preferences and on the idea of it, attain well-informed choices. It’s evident within the present situation that the intuition of people is to observe behavioral economics, combining ideas of psychology and economics to get an understanding about how people observe a sure type of conduct in the true world.

Nevertheless, although AI analyzes behaviors of individuals in addition to portions of knowledge, it’s not a substitute asset. Collectively, AI and People could make determination making extra exact, administration groups outline accountability, help investments with correct knowledge, as AI focuses on monitoring markets while people contemplate potential shocks such us conflict or pandemics.

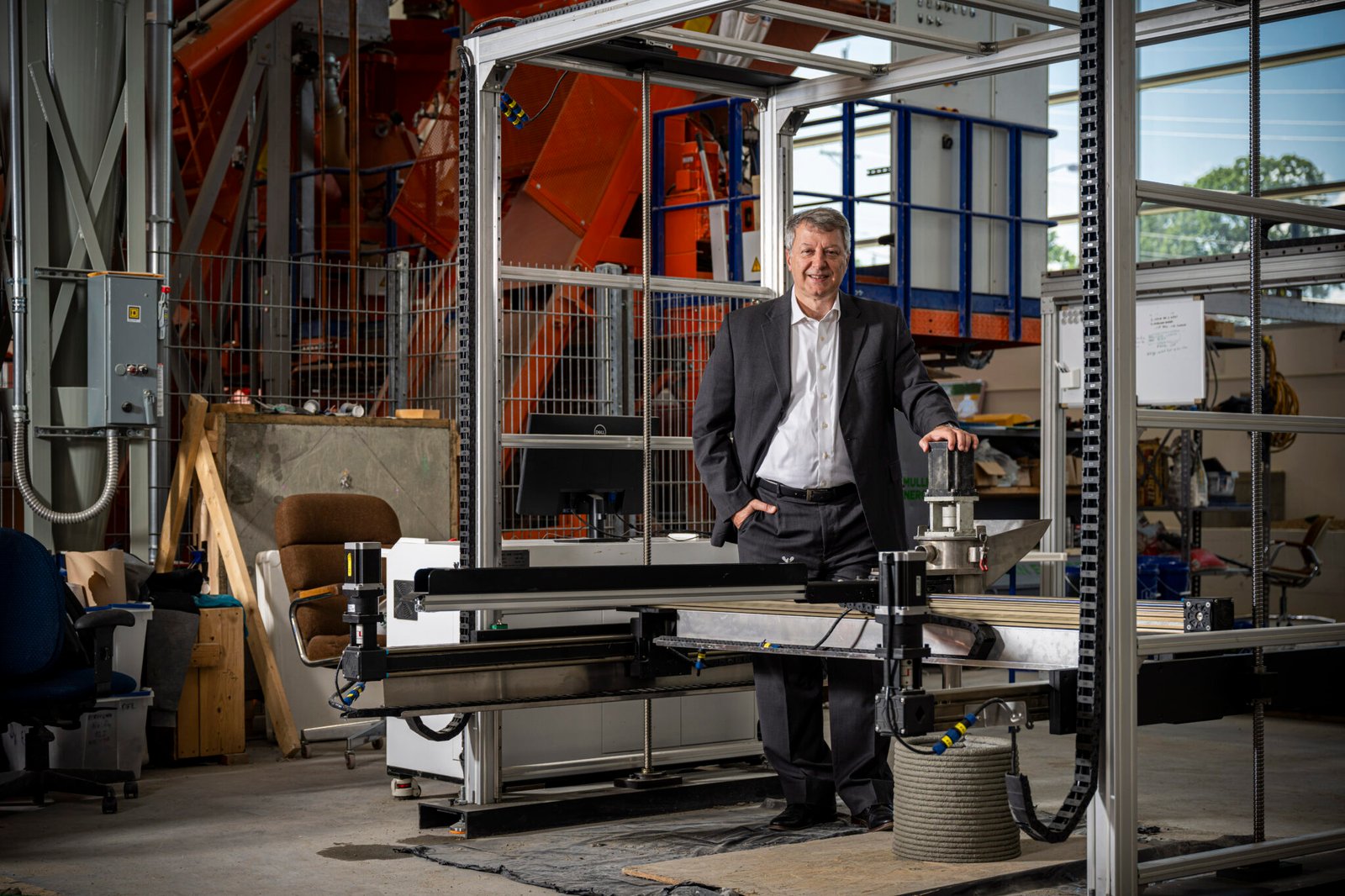

Over 10 years in the past, I developed the algorithm of buying and selling securities. This was nothing greater than an AI system analyzing giant quantities of knowledge, together with historic market traits, information articles, monetary reviews, and extra. We might determine patterns, traits and make funding choices primarily based on a wider vary of knowledge that was not attainable for a dealer alone. We predicted extra precisely the way forward for market traits and worth actions. Our know-how enabled us to determine if we must always purchase, maintain or promote a safety.

Our merchants accessed a greater image of dangers supported by our know-how offering a full threat evaluation of market volatility and even geopolitical dangers. We might obtain most returns with an environment friendly portfolio.

For onboarding purchasers to be financed, we’re standardizing credit score profiles by way of AI know-how. Our credit score crew can use instruments minimizing time, analyzing extra knowledge to determine about investing. In compliance, we assess the ‘people’ behind the enterprise and conduct threat administration, together with safety, regulatory compliance, fraud, AML and KYC pointers.

To outlive within the monetary business, you want to champion digital transformation. AI will carry a number of optimistic results corresponding to accuracy, precision in predicting future wants; optimization of capital funding choices; discount of guide knowledge entry and evaluation. We additionally can’t ignore the dangers that this transition course of brings, e.g., regulatory, knowledge safety, consolidation between machines and people. Our each day decision-making processes should assure a full alignment between people and machines.

Fb Twitter Linkedin E-mail Disclaimer Views expressed above are the writer’s personal.